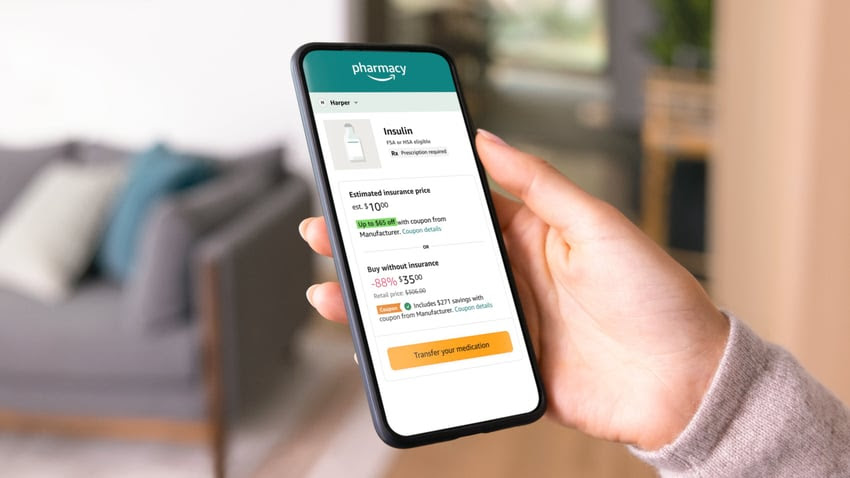

To help rein in prescription drug costs, which is a big pain point for employers, new players like Amazon Pharmacy and Mark Cuban Cost Plus Drug Company will need to focus on specialty drugs, analysts say. (Amazon Pharmacy)Leveraging its logistics and supply chain muscle, now including drone delivery, Amazon wants to make it faster and easier for patients to get their prescription medications and speed up “triage to treatment.”Amazon Pharmacy, which launched three years ago after the company acquired PillPack in 2018, announced Oct. 18 that it was launching drone delivery for prescription medication orders with the service initially taking flight in College Station, Texas.Amazon Pharmacy also offers two-day medication delivery to Prime members and same-day ground delivery in five select cities—Austin, Seattle, Phoenix, Indianapolis and Miami.Amazon Pharmacy has largely been focused on price transparency and affordability of branded and generic drugs. Amazon rolled out RxPass, a prescription drug subscription for Prime members, as well as a new feature to make it easier for consumers to use manufacturer discounts on branded meds by integrating the coupons into the checkout experience.

With drone delivery and same-day home drop-off, Amazon also is focused on speed to treatment, according to executives.

“Drone delivery of medicine, the ability to connect patients to treatment in under an hour, represents a transformative shift in how we in the clinical community can administer care to our patients,” Vin Gupta, M.D., Amazon Pharmacy’s chief medical officer, said during the company’s Delivering the Future innovation event in Seattle two weeks ago.

John Love, vice president of Amazon Pharmacy, told reporters during the event that the legacy pharmacy experience hasn’t evolved in decades. It still involves driving to the pharmacy, waiting in line and then finding out how much medications cost when you’re checking out, all the while increasing the risk of spreading infection.

The COVID-19 pandemic ushered in the accelerated adoption of at-home testing kits and telehealth visits to get diagnosed from your living room. But there is still a significant lapse in getting treatment.

“Even as home tests and telehealth consultations are becoming more widely available, rapid access to treatment has not followed suit,” Gupta said. “With drone delivery, medication can be delivered to someone’s home with zero direct contact with another human being in under an hour. That’s not just unprecedented speed and convenience, that’s limiting the spread.”

As a practicing pulmonologist and intensive care physician, Gupta says he understands the critical importance of the “golden window” of treatment time.

He recalled a 70-year-old patient in the Seattle area with emphysema who was battling what he suspected was the flu. It took the patient four days to get a diagnosis between ordering a flu test through a primary care provider to getting the test results.

“It took an additional 72 hours before he got the medications. We’re talking about almost a week of lapsing from symptom onset to getting that first dose of Tamiflu,” Gupta said. “That dose ideally goes in the body within 48 hours of feeling unwell. That’s unacceptable.”

He added, “The pandemic shined a bright light on this reality and the various ways we can’t optimally care for patients in their greatest moments of need, especially when battling an acute illness.”

Combined with Amazon’s other healthcare offerings, including Amazon Clinic and One Medical, drone delivery service speeds up “triage to treatment” for patients, Gupta said.

Amazon’s work in healthcare, to date, demonstrates how the company is trying to “innovate, solve real patient problems and deliver real clinical impact,” he said.

“While we’re just starting out this care delivery mechanism, this framework represents the best of medicine. Tailoring diagnosis to treatment in under an hour, that’s a standard of care we want for patients whether they traveled to a healthcare facility or decided to stay at home,” he said.

During an interview with Fierce Healthcare on the sidelines of the innovation event in Seattle, Love hinted that Amazon Pharmacy would be expanding same-day prescription medication delivery to additional cities or markets by the end of 2024.

Amazon Pharmacy’s focus on making it faster and more convenient for patients to get prescription medications comes as brick-and-mortar drugstores are limiting pharmacy hours and even closing locations across the country.

Roughly one out of every eight pharmacies closed between 2009 and 2015, which disproportionately affected independent pharmacies and low-income neighborhoods, according to a study published in the Journal of the American Medical Association.

According to researchers in a study published in JAMA, pharmacy closures lead to health risks such as older adults failing to take medication.

Earlier this month, retail pharmacy chain Rite Aid filed for bankruptcy protection in an effort to address lawsuits over its alleged role in the opioid epidemic and a debt load rising to nearly $4 billion. The drugstore chain operates 2,100 retail pharmacy locations and plans to close underperforming stores and sell off some of its businesses. The Wall Street Journal reported in September that it was planning to close 400 to 500 stores in bankruptcy and either sell or let creditors take over its remaining operations, citing people familiar with the matter.

CVS Health said in November 2021 that it plans to shutter approximately 900 stores over the next three years. The company said it planned to close 300 stores a year as it reevaluates its in-person retail strategy with more consumers going digital.

Walgreens said in 2019 it would close 200 stores and in June announced an additional 150 store closures, CNN reported.

Patients often have two choices to get their prescription drugs: either brick-and-mortar drugstores, many of which are limiting their hours, or mail-order delivery that typically takes five to 10 business days, according to Love.

Amazon’s fast delivery options can improve access to care and healthcare equity, he said.

“Pharmacies are not equally distributed around the United States at the same quality and the same hours,” he said during the interview.

Amazon executives also claim that getting patients faster, more convenient access to medications will help address the stubborn non-adherence challenge.

The Centers for Disease Control and Prevention (CDC) estimates that non-adherence causes 30% to 50% of chronic disease treatment failures and 125,000 deaths per year in this country.

And, CDC data show that 25% to 30% of new prescription are never filled at the pharmacy.

Amazon is building out its pharmacy services as it scales up its other healthcare businesses. In February, the company finalized its big-ticket acquisition of One Medical, a hybrid virtual and in-person primary care service. It also rolled out Amazon Clinic, a virtual health service targeting 35 common conditions, including a newly launched cold and flu condition service.

There is skepticism about Amazon’s ability to scale its healthcare initiatives as previous ventures have faltered. One of Amazon’s most high-profile forays into healthcare, Haven, a company formed with JPMorgan Chase and Berkshire Hathaway, shuttered after three years of operation.

The company also shuttered Amazon Care, its hybrid care service, in late 2022.

Gupta said there were important lessons learned from Amazon Care, primarily that delivering healthcare services to patients in their homes could shift the experience from “reactive” to “preventive and more focused on wellness.”

“When I think about what we’re building across One Medical, Amazon Clinic and Amazon Pharmacy, it’s really that focus on how do we keep people healthy, at home and out of emergency rooms. I think that through line and that conviction still rings true today,” he said.

“As we evolve our health offerings, we’ve learned the importance of having a nationwide set of capabilities, so 24/7, virtual access to One Medical, and the ability to do a synchronous visit for an episodic event with Amazon Clinic and the ability to get a full-service pharmacy inclusive of insurance, cash discounts and a broad range of medications delivered to your doorstep is super important,” Love said. “But also we’re learning about local and how do we get really fast. Everything that we’ve done folds into the next product or service that we launch.”

Are specialty meds the missing piece?

In August, Blue Shield of California made a big splash when it announced it would sever most of its ties with CVS Health’s Caremark, its current pharmacy benefit manager, and instead partner with Amazon Pharmacy, Abarca, Mark Cuban Cost Plus Drug Company and Prime Therapeutics to manage prescription costs of its health plan members.

Blue Shield of California said it hoped the new model for pharmacy care would overhaul the “broken prescription drug system.” Amazon Pharmacy will provide home delivery of prescription medications for the insurer’s nearly 5 million members.

“The team at Blue Shield had a few ideas in mind, which was, what if we could get a bunch of innovative players who are like-minded and really focus on the value to the end customer and design it from the ground up of working with the manufacturers, the pharmacy in Amazon and Prime Therapeutics as the pharmacy benefit manager to design the formulary, so that it’s a different experience,” Love said.

Amazon Pharmacy currently works with 16 Blues plans, he noted.

“We are stacking up these little things to make it a little bit more affordable and a little bit more convenient for patients engaging with a system that’s badly in need of change, and we’re committed to work with industry partners to create a better experience,” Love said.

Mark Cuban Cost Plus Drug Company and Amazon’s pharmacy operations are competitors but are also working together as part of the Blue Shield of California pharmacy model. Love said he “applauds” other forward-thinking companies who jump into healthcare to solve challenges.

But some analysts have pointed out that as part of the Blue Shield of California pharmacy model, Caremark will still handle specialty drugs, which account for more than half of drug spending in the U.S.

To help rein in prescription drug costs, which is a big pain point for employers, new players like Amazon and Mark Cuban’s company will need to focus on specialty drugs, analysts say.

“It is important to note none of these companies offer wraparound PBM services, which we believe are a significant value-add to clients in providing access to drugs and managing total drug spend,” JPMorgan Securities Managing Director Lisa Gill wrote in a report in August. “Generics represent only about 15% of total drug spend, and our survey work has consistently indicated rising specialty costs, not generics, are the biggest pain point for large employers.”

Love said there are no plans for Amazon Pharmacy to expand into specialty medications at the moment.

“We’re going to go where we can make the most customer impact. Most medications that are dispensed in the United States are branded and generic medications for common conditions,” he said.

Leave a Reply